Many people wonder if investing in high-dividend stocks in Japan is really profitable. In this article, I will explain the key points for choosing high-dividend stocks in Japan along with my own performance results during a period of about six months in a bear market.

There is a proper way to select high-dividend stocks in Japan, which is not just choosing stocks with high yields but also those with promising growth potential.

By mastering the basics of selecting high-dividend stocks, investors can achieve a peaceful stock investment even in a bear market, making it a recommended option for those who prefer stable investments.

Table of Contents

This article is written by someone who:

- Has 5 years of experience in short-term investments and 5 years of experience in long-term investments

- Is skilled in both high-dividend stock investment and index investment

- Holds a first-class Financial Planner certification

- Is a CFP (Certified Financial Planner) holder.

What are high-dividend stocks?

High dividend stocks refer to stocks with a high dividend yield. As of March 2022, the average dividend yield of listed Japanese companies is 1.9% (simple average yield of the first section of the Tokyo Stock Exchange). Although there is no clear definition, generally speaking, stocks with a dividend yield of 3% or more can be considered high dividend stocks.

In addition, high dividend stocks have significant advantages compared to real estate investments. In the case of revenue-generating properties located in the urban areas of Japan that have recently been built, the prevailing yield rate for these properties is generally around 4% to 4.5%. However, in real estate investments, various maintenance costs such as property taxes, repair costs, and management fees must be paid, resulting in an effective yield rate of around 3% to 3.5%. Also, vacancy risk should be taken into account.

If the yield rate is similar, high dividend stocks that provide dividend payments without requiring any effort after purchase are more convenient than real estate, which requires maintenance and management efforts.

Key points and considerations for selecting high-dividend stocks

The important rule in selecting high dividend stocks is to buy stocks of companies that have stable performance and continue to pay dividends steadily.

Specifically, check the following points:

- PER (Price-to-Earnings Ratio)… 15 times or less (preferably 10 times or less)

- PBR (Price-to-Book Ratio)… 1 time or less

- Sales… Is it steadily increasing with little fluctuation?

- Operating profit margin… Generally 10% or more?

- EPS (Earnings per Share)… Is it steadily increasing?

- Equity ratio… Generally 60% or more?

- Cash flow from operating activities per share… Is it in the black and steadily increasing?

- Dividend per share… Is there stability and growth?

- Dividend payout ratio… Generally 50% or less? (Too high is dangerous)

If the above points are cleared, it can be considered as a good stock. Additionally, it is also good to have an idea of generally clearable points, even if all items cannot be cleared.

The IR Bank website is useful for confirming the stability of these stocks. This is because you can check the financial information of all Japanese companies.

We have previously written an article on how to use IR Bank to check corporate financial information, so please refer to the following article as well:

The important point to note is not to choose stocks that are only high in dividend yield. This is because if the dividend yield is too high, there may be concerns about the future continuation of dividends or an increase in the risk of a stock price decline.

Was this response better or worse?BetterWorseSame

High-dividend stocks in Japan that I actually purchased

Below are the Japanese high dividend stocks that I have been investing in since around September 2022, carefully selected based on the criteria I explained earlier to ensure stable performance and dividends.

With SBI Securities, you can purchase Japanese stocks even in units of 1 share. I evenly distributed my investments among these stocks and invested approximately 3 million yen in 2022. Since then, I have added several hundred thousand yen in smaller increments and currently have a total investment of around 3.8 million yen.<Investment Stocks>

Sekisui House Ltd (1928)

- Sekisui House Ltd (1928)

- JAC Co Ltd (2124)

- CDS Co Ltd (2169)

- Japan Tobacco Inc (2914)

- Nihon SHL Co Ltd (4327)

- Takeda Pharmaceutical Co Ltd (4502)

- Nakoto Co Ltd (4627)

- Alps Alpine Co Ltd (4641)

- Sumitomo Rubber Industries Ltd (5110)

- Asante Inc (6073)

- Balkrishna Industries Ltd (7995)

- Mitsubishi Corporation (8058)

- Sumitomo Mitsui Banking Corporation (8316)

- JACCS Co Ltd (8584)

- ORIX Corporation (8591)

- Mitsubishi HC Capital Inc (8593)

- Sompo Holdings Inc (8630)

- Tokio Marine & Nichido Fire Insurance Co Ltd (8766)

- NTT Corporation (9432)

- KDDI Corporation (9432)

- SoftBank Group Corp (9434)

- Okinawa Cellular Telephone Company (9436)

- Electric Power Development Co Ltd (9513)

- Subaru Corporation (9632)

- Gakken Holdings Co Ltd (9769)

- Yellow Hat Ltd (9882)

Performance results for six months

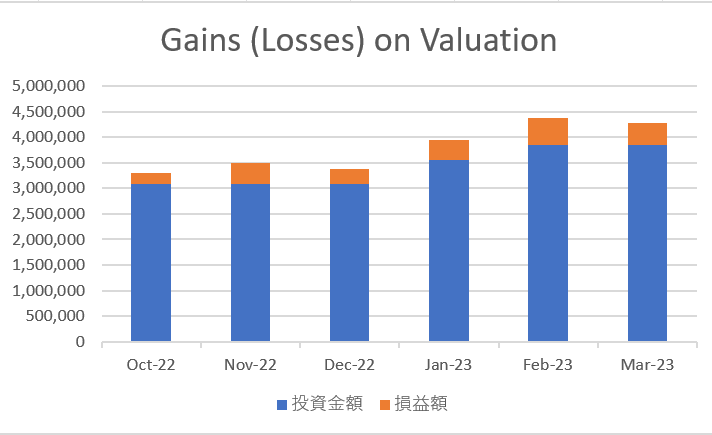

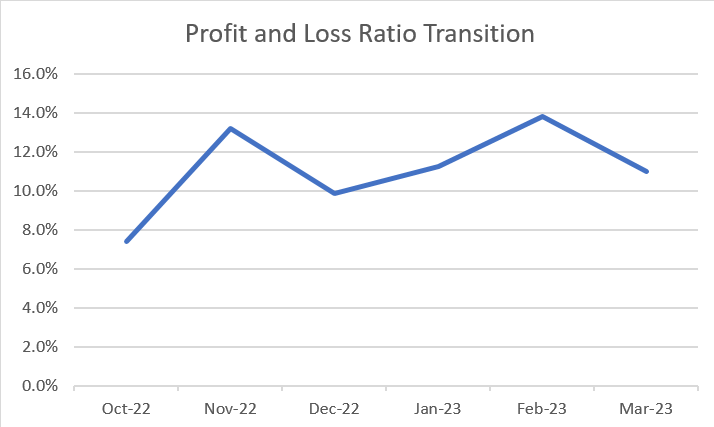

The investment results from September 2022 to March 2023 are as follows, with additional investments made in January and February using bonuses.

| Date | Investment Amount | Amount of profit/loss | Percentage gain/loss |

| Oct-2022 | ¥3,078,292 | +¥227,665 | +7.4% |

| Nov-2022 | ¥3,078,292 | +¥406,822 | +13.2% |

| Dec-2022 | ¥3,078,292 | +¥304,349 | +9.9% |

| Jan-2023 | ¥3,544,708 | +¥399,910 | +11.3% |

| Feb-2023 | ¥3,846,512 | +¥532,266 | +13.8% |

| Mar-2023 | ¥3,845,656 | +¥422,964 | +11.0% |

Let’s also take a look at the movement of the Nikkei Stock Average as a comparison.

It can be seen that even during the decline of the Nikkei Stock Average, the stock prices of the selected high dividend Japanese stocks did not drop significantly and have been relatively stable in their growth.

Furthermore, during this period, the total amount of dividend income received was 52,356 yen.

Challenges and issues experienced during the investment period

I would like to talk about the issues and problems that I have noticed while investing in high dividend stocks.

The first issue is the timing of entry, which is difficult.

Since we are investing in high-quality stocks that are expected to have high stability, we should expect them to rise in the long run, so it should be okay to enter at any time. However, when we try to buy, we often have unnecessary doubts such as whether the price is too high or if the price will go down further.

Ideally, it would be best to secure ample funds and buy them all at once when the stock price drops. However, as humans, emotions can get in the way.

The second issue is that the dividend is only paid twice a year.

When investing in high dividend stocks, receiving the dividend is a significant motivation.

From a dividend perspective, Japanese stocks are inferior to US stocks, as they only pay dividends twice a year compared to US stocks, which are paid quarterly.

Future investment strategy

The basic strategy for investing in high dividend stocks is to buy and hold them instead of selling them after purchase.

Investing in high dividend stocks is a strategy that prioritizes cash flow over capital gains. Going forward, the plan is to continue to accumulate more shares and increase the number of holdings.

In addition, there is a saying in Japanese stock investing: “You must be there when the lightning shines.” This means that you need to take a position when there is a tremendous upward momentum or else you will miss out.

Personally, I believe that if a company has sound financials, its stock price will rise in the long run. Of course, I also diversify my investments into multiple companies to prepare for any possible risks.

Conclusion

Investing in high dividend stocks is often compared to index investing, but I believe that the two have fundamentally different objectives.

If you focus on expanding your assets, then index investing is undoubtedly the most efficient method.

Investing in high dividend stocks is a strategy that aims to generate cash flow and enrich your daily life. While future wealth is important, current prosperity is also a crucial factor in life satisfaction.

Furthermore, Japanese high dividend stocks have an interesting aspect that is not found in US high dividend stocks. This is the need to create your own portfolio by selecting individual stocks. While there are many excellent ETFs for US stocks, unfortunately, there are none in Japan. Therefore, the process of selecting stocks and designing a portfolio is necessary.

Designing your own portfolio increases your awareness that “you are investing.” I also think that this is one of the interesting aspects of investing.

Thank you for reading this far!

【Sponsored link】

◆Start Your Stock Investing Journey with the No.1 Online Broker – SBI Securities

◆Open a New Account with the Industry’s Top Performer! Start Trading Stocks with Rakuten Securities